Tax classes are displayed at the top of the tax screen. Click one to view tax rates for the class.

In the tax rates table, you can define tax rates (one per row). Click Insert Row to get started.

The wildcard character (*) in this context means “apply to any”, meaning it will apply regardless of what is entered in that field. Should you choose to replace it with something specific, the customer will have to match exactly what you put in order for it to match. E.g. if you put “Cape Town” as the city, but your customer types “Capetown”, it will not match and the tax rate will not apply to their address.

Each tax rate has these attributes:

- Country Code – 2 digit country code for the rate. Use ISO 3166-1 alpha-2 codes. Leave blank (*) to apply to all countries.

- State Code – 2 digit state code for the rate. For the US, use a 2 digit abbreviation e.g. AL. Leave blank (*) to apply to all states.

- ZIP/Postcode – Enter postcodes for the rate. You may separate multiple values with a semi-colon (;), use wildcards to match several postcodes (e.g. PE* would match all postcodes starting with PE), and use numeric ranges (e.g. 2000…3000). Leave blank (*) to apply to all postcodes.

- City – Semi-colon separated list of cities for the rate. Leave blank (*) to apply to all cities.

- Rate % – Enter the tax rate, for example, 20.000 for a tax rate of 20%.

- Tax Name – Name your tax, e.g. VAT

- Priority – Choose a priority for this tax rate. Only 1 matching rate per priority will be used. To define multiple tax rates for a single area you need to specify a different priority per rate.

- Compound – If this rate is compound (applied on top of all prior taxes) check this box.

- Shipping – If this rate also applies to shipping, check this box.

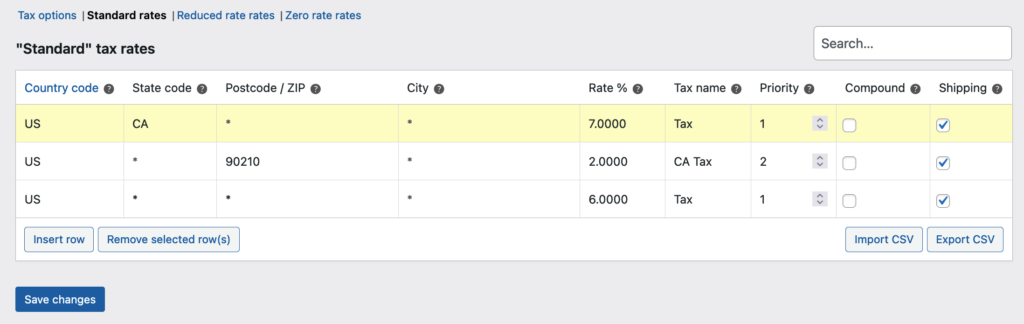

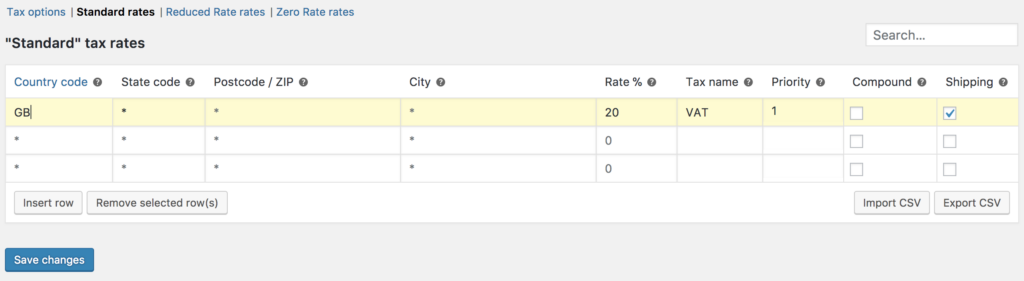

Tax rate examples

Here is an example of a tax setup for a UK store — 20% for UK customers only.

In this example, we have a 6% tax rate for all U.S. states except California, which has a 7% tax rate and a local tax rate of 2% for ZIP code 90210. Notice the priorities — this demonstrates how you can ‘layer’ rates on top of another.